What is cash flow and why do you need to forecast it?

12 December 2022Cash flow represents the movement of money in and out of a business. While profitability focuses on the value of services provided versus costs incurred, cash flow encompasses the actual cash transactions. This section clarifies the distinction between cash flow and profitability and emphasizes the importance of forecasting cash flow to ensure timely payments and maintain a healthy cash reserve.

Our recent research indicates that “cash flow” and “cash flow forecasting” are not as universally understood terms as one might think. And since we refer to tailwindapp.eu as a cash flow forecasting app, we decided to use our first blog post to explain what exactly we are at tailwindapp.eu helping entrepreneurs with.

During the process of building tailwindapp.eu, we interviewed more than 100 entrepreneurs from 6 countries. We wanted to find out as much as possible about whether they currently do any kind of cash flow planning and if yes, how exactly they do it and whether they would like to improve anything.

Most of our conversations were with owners and managers of marketing agencies, technology firms, law firms, architects, consulting firms and other businesses that are sometimes referred to as “professional services firms”. These firms typically had up to 30 employees and did not have an in-house finance manager or accountant; they used services of external accounting firms instead.

Not surprisingly, they were not using much of the typical “finance jargon” you would often hear from employees of large corporations. We found that explaining the essence of cash flow planning in a few sentences was often helpful, so here we go!

Building an Effective Cash Flow Forecast

To build an effective cash flow forecast, start by setting clear objectives and determining the desired forecasting period. Gather accurate financial data from various sources, such as bank statements and accounting records. Analyze past cash flow patterns, incorporate anticipated changes, and regularly review and update the forecast to ensure accuracy and adaptability. Monitor actual cash flow against the forecast for better financial management.

1. Define Your Forecasting Objectives:

Identify the specific business objectives your cash flow forecast aims to support, such as liquidity planning, debt management, risk mitigation, or growth strategies.

2. Determine the Forecasting Period:

Choose an appropriate forecasting period based on your business’s needs and desired level of detail, considering short-term, medium-term, or long-term forecasts.

3. Select a Forecasting Method:

Decide between direct and indirect forecasting methods based on available data and the forecasting period. Direct forecasting utilizes actual cash flow data, while indirect forecasting relies on projected financial statements.

4. Source the Required Data:

Identify relevant data sources within your organization, including bank accounts, accounts payable and receivable, and accounting software. Extract essential data, such as opening cash balance, cash inflows, and cash outflows, to ensure accurate forecasting.

Is cash flow different from profitability?

Cash flow is sometimes confused with profitability. While there is some degree of correlation between the two, your company can also be:

- Very profitable but struggling to make its payments on time; or

- Loss making but with huge cash reserves.

Profitability is determined by comparing the value of services you provide to your clients vs the costs you incur to provide these services. If the value (or more precisely, the price your client agreed to pay) is higher than the cost, your company is profitable. If the cost exceeds the value, it makes a loss.

When it comes to forecasting your company’s cash flow, the main question you are trying to answer is “will we be able to make all necessary payments on time”? Several factors are being taken into consideration, including:

- When will your clients pay you?

- When do you have to pay your employees and suppliers?

- Are you planning to make investments into new products that do not generate any revenue yet?

- Are you planning to borrow money from banks or other lenders?

- Are you planning to repay any loans?

- Are your shareholders planning to invest additional capital or receive dividends?

How about a practical cash flow example?

Let’s assume you run a software development company and on 1 January you win a client who promised to pay EUR 160k for software that you will build and deploy until 31 Dec. It is your only client, everyone in the company is working on this project and your total costs are EUR 10k a month. If everything goes according to plan, your revenue for the year will be EUR 160k, costs EUR 120k and profit EUR 40k. Sounds great so far, doesn’t it?

But let’s check the contract now and it says your client will make a first payment of EUR 10k after the Phase 1 which has to be finalized by 31 March, further EUR 30k after Phase 2 which has to be finalized by 31 July and the remaining EUR 120k only after full completion of the project on 31 December. If you complete the work as agreed, you will be entitled to issue invoices on these dates and the client will have 30 days to pay them. In contrast, you have to make EUR 10k in outgoing payments every month no matter whether the project is on track or not.

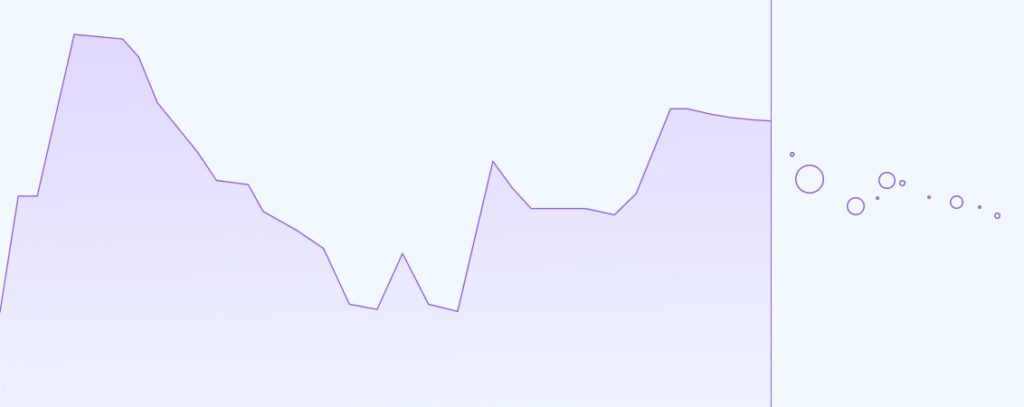

If you start the year with a bank account balance of 0 EUR, it’s not looking pretty. Your company will only receive the final EUR 120k payment in January of next year and you will be struggling to pay your bills all the time:

What can you do to improve your situation?

Ideally, you should do such a cash flow forecast before signing the contract with the client – what if you can renegotiate more favourable payment terms?

Also, in this case we assumed the company has only one client; typically there are others. Maybe the payments coming in from other clients can finance the temporary shortfall of this project?

Maybe you have a large line of credit with your bank? Great if you do but the bank will charge interest and that adds to the cost and shrinks your profit.

Perhaps your shareholders can lend you on more favourable terms?

There are many ways you can “fix your cash flow”. Options considered and your assumptions change over time, sometimes even several times a day. Therefore we made it really easy to do modelling in tailwindapp.eu. To begin with, you can add planned transactions at a very early stage – before signing the contracts. You only need to add the amount and counterparty name. And you can reschedule transactions to a different date using “drag and drop” in an instant.

Advantages of Cash Flow Forecasting

Cash flow management offers numerous advantages for businesses. It provides visibility into the financial health of the organization, allowing for better decision-making and planning. By monitoring cash inflows and outflows, businesses can avoid cash shortages, optimize cash utilization, and ensure timely payments to suppliers and employees. Effective cash flow management also helps in identifying areas for cost reduction, improving profitability, and maintaining a strong financial position in the market.

Streamlining Cash Flow Forecasting with Automation

Automating cash flow forecasting streamlines processes, increases accuracy, and enables proactive financial planning.

Increased Efficiency: Automation in cash flow forecasting eliminates manual data entry and calculation processes, saving valuable time and reducing human errors. It streamlines the entire forecasting process, allowing businesses to generate accurate and up-to-date forecasts quickly.

Improved Accuracy: Automation tools can access real-time data from multiple sources, ensuring accurate and reliable cash flow forecasts. By eliminating human bias and inconsistencies, businesses can make more informed financial decisions based on precise and reliable information.

Coming back to explaining cash flow forecasting – it is a continuous process of reviewing your plans and assumptions to make sure your company will never run out of cash.

Entrepreneurs do it in different ways and we will discuss some approaches in one of our next blog posts. But we hope you agree cash flow forecasting is an important part of running a business!