How granular should my cash flow forecast be?

18 July 2025Is it sufficient to plan expected monthly totals for incoming and outgoing payments? Or do we need to plan on weekly or even daily level?

Long story short: we strongly recommend to plan on daily level at least for the next 2-3 months. Unless you have a large cash reserve.

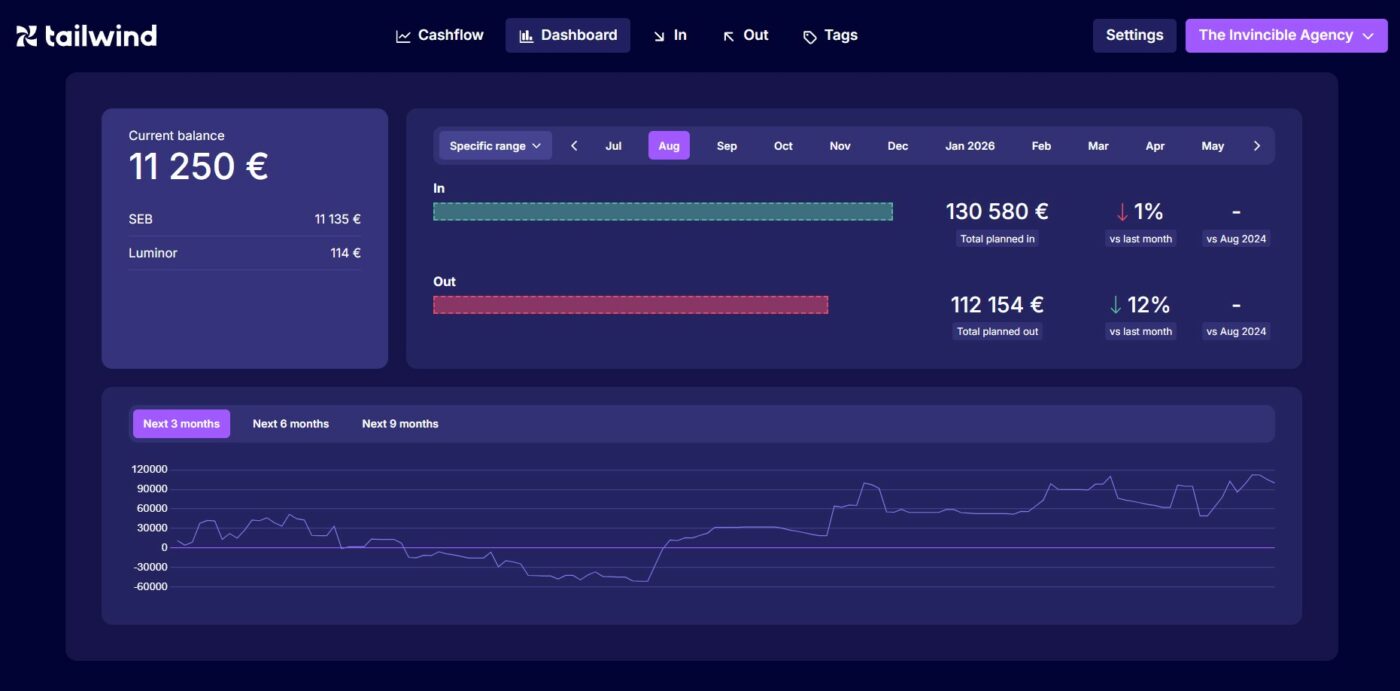

Here’s a visual explanation. Below is a monthly summary of a cash flow forecast.

As you can see, the total value of expected incoming payments during August is a little over EUR 130k while the total value of expected outgoing payments is a little over EUR 112k. Nothing to worry about, right?

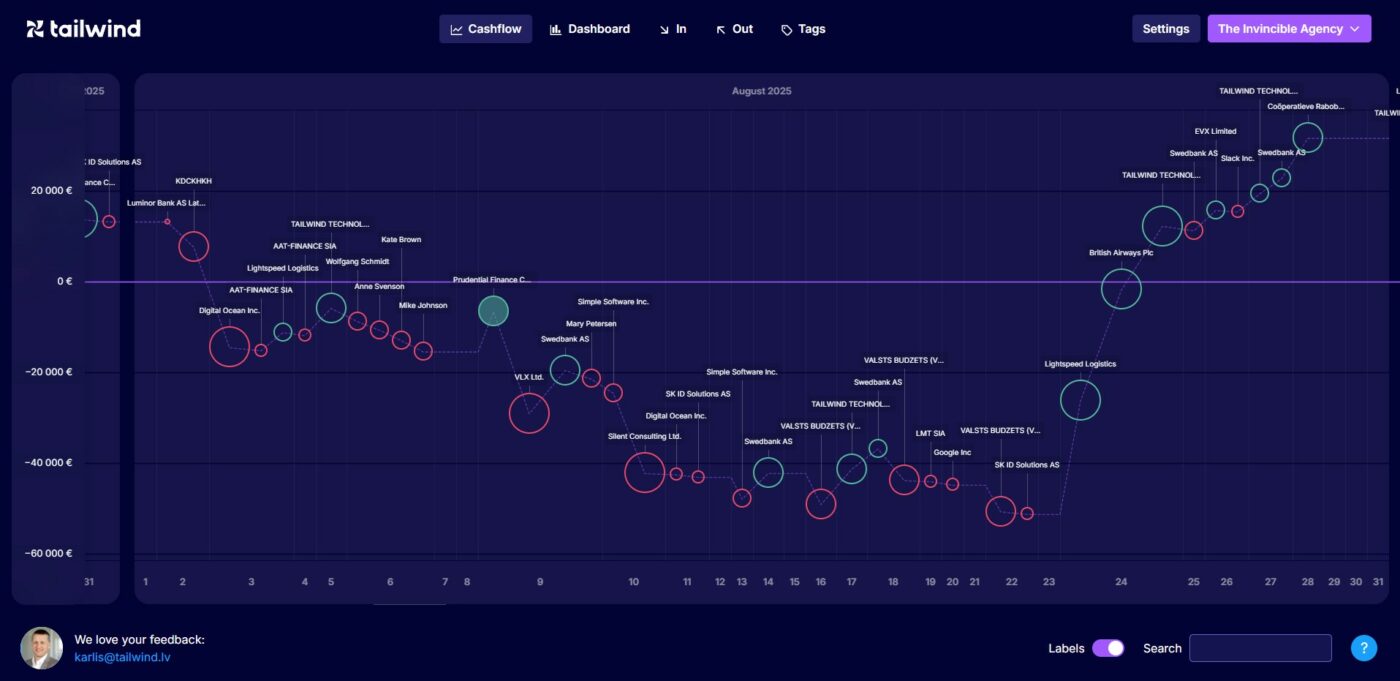

Wrong. Check out the same forecast but only on a daily level:

Most of the incoming payments are planned for the first part of the month while most of the incoming payments will only arrive at the end of the month. For at least 3 weeks the company will have to delay the payments to at least some of the suppliers or employees.

Quick rule of thumb is “cash reserve equal to at least one month of expenses”. So if this company had a cash reserve of EUR 130k or more at the beginning of August, it would still be making payments on time. And therefore planning only for the monthly totals would be acceptable.

But you don’t have to choose either one or the other. Tailwind financial planning app allows you to do both daily and monthly forecasts and the same time. And it updates itself every time you log in and offers “drag & drop modelling” as well as many other useful features that make it very easy to be in control.

Financial planning can and should be simple!