Does your cash flow allow you to sign that new contract?

23 August 2024One of the key clients of your agency or consulting firm has just called and said they are prepared to go ahead with the a major project that you have recently discussed. They have emailed you the contract draft. Should you sign it?

It is tempting to answer “hell, yeah!” – but it helps to check your cash flow forecast first.

You sure want the extra revenue the new project will bring. And if the project goes really well, it may greatly enhance the reputation of your firm.

But you don’t want to run into trouble, at least without knowing it. What if you have to pay your suppliers before you receive payments from the client? Will you still be able to make all remaining payments on time?

Should you sign regardless of that – or perhaps you should renegotiate the payment terms with both the client and the supplier before signing? It might not be easy – but it is sure easier before you sign the contracts rather than after that! Or perhaps you need to secure a line of credit for your bank. Again, the earlier you do it, the better.

To make decisions like that you need a reliable cash flow forecast. Spreadsheet won’t do – because spreadsheets take a lot of time to update. And a forecast is useless unless it is updated and granular enough – you should forecast on daily rather than weekly or monthly basis.

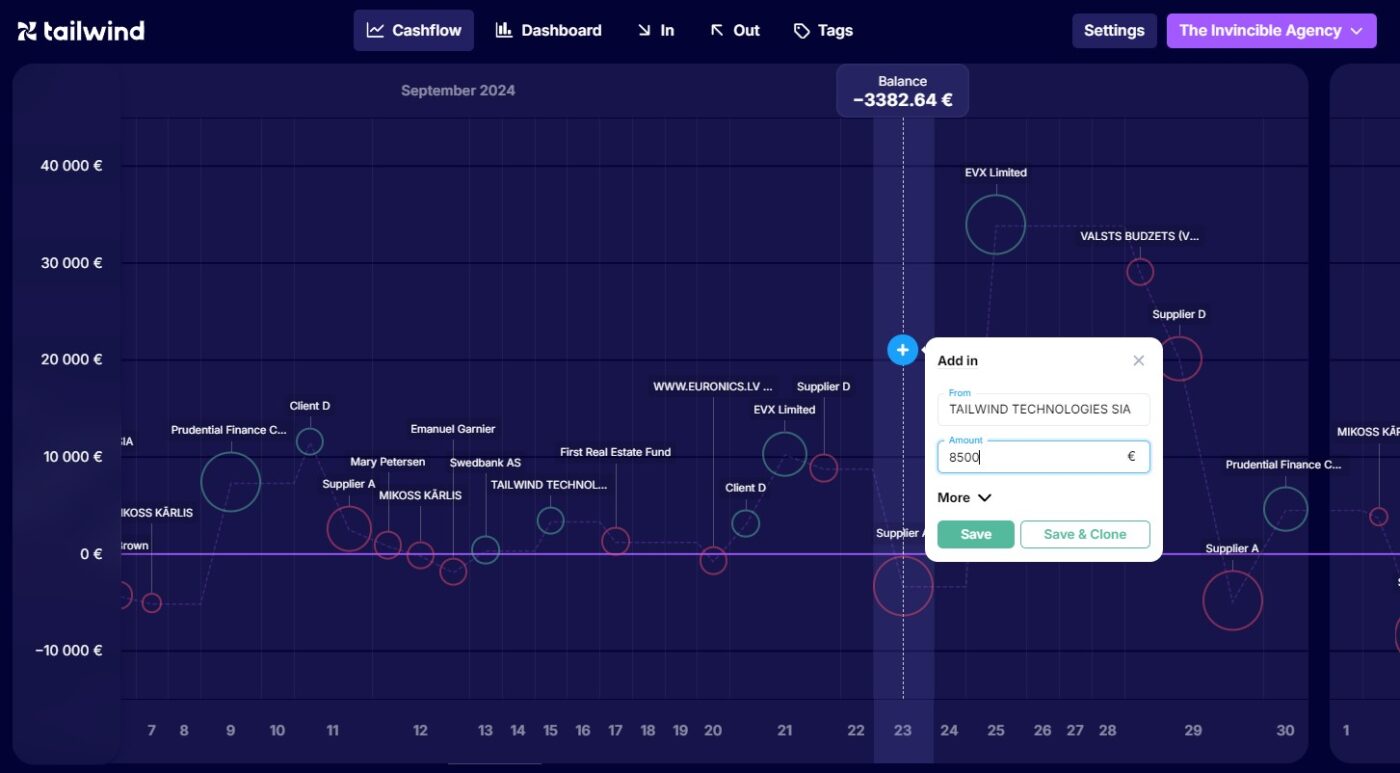

In other words, you need Tailwind. First of all, Tailwind is visualized – shows your cash flow as series of events on the timeline. So you can immediately see what your outlook looks like before taking into account this new contract.

Thanks to smart automation, your Tailwind forecast updates itself. Which means – you don’t have to spend your precious time checking your bank account statement and retyping numbers. Every time you log in, Tailwind compares most recent transactions on your bank account with your forecast and whatever has been received or paid is marked as such and removed from the forecast.

And whenever you want to add any new assumptions, you only need a few seconds. Just click above the date when an incoming or outgoing payment is likely to be received or made, add counterparty name and amount and that’s it! The you can use “drag and drop” to see how will your expected bank account balance change if any of the planned transactions happens few days earlier or later.

So yes, not only we recommend to check your cash flow forecast before signing each new contract but we have also built a simple and easy way to do it!