Checking invoices is a good start – but only a start.

27 June 2025“Yes, we do financial planning – we check amounts and due dates on invoices we have issued or received and are planning our cash flow based on that”.

We have interviewed hundreds of entrepreneurs on their financial planning practices and have heard this answer quite often. For sure, planning in this way is much better than not planning at all – but there is one major limitation.

Is 3-4 weeks really sufficient?

If invoice data (plus your payroll) is all you look at, in most cases this will only show your expected cash balances for the next 3-4 weeks. Is this really sufficient for your company?

It might be – in case your company either has large cash reserves or your “contract to cash cycle” is not longer than 3 weeks. But very few companies have either one or the other.

“Contract to cash cycle” is the amount of time it takes for your company to win a new client (or a new order from a current client), do the work, issue an invoice and get paid.

Why is it important? Because the whole point of financial planning is to understand whether your company is likely to meet its financial objectives. As a minimum, you want to make sure that your company will be able to pay its bills on time.

And if the forecast shows that a cash shortage is likely, you want to identify it while you still have time to avoid it. And the most sustainable way of improving your cash flow is to win additional business from your clients. If your forecast only allows to see 3-4 weeks ahead but your “contract to cash cycle” is 3+ months, then you are not protecting yourself from unproductive stress.

How long is long enough?

“Contract to cash cycles” vary a lot from one company to another, so does the recommended planning horizon. As a minimum, we recommend “contract to cash plus one month”. This means your planning period should exceed your “contract to cash cycle” by at least one month.

So if it takes you 5 months to win a new client, do the work and get paid – you should plan for 5+1 or 6 months as a minimum. Again – because you want to have a chance to prevent cash shortages from materializing.

Even if you decide that winning a new client is not going to be a solution (or the only solution), you need a longer planning horizon.

For example, if you decide to borrow from your bank. It might take just 1-2 months to secure the loan. But your bank will be curious to understand whether your company is likely to repay the loan on time. And you will need a cash flow forecast to convince them.

But how can I predict expected payments 5-6 months from now?

You can’t be 100% certain of any assumptions. But it is perfectly fine to use your best guess.

Let’s assume you run a construction firm. Most likely your firm is delivering on several contracts at the moment and are tracking expected completion dates on all of the projects. Invoicing dates are typically dependent on completion dates and payment terms have been agreed in the contracts.

So you can figure out when should you receive payments from each client if your firm completes the work as expected. You can also predict when will the supplier invoices be due based on the progress of each project. And you can apply similar assumptions for contracts that you are only planning to secure.

How can I keep track of all that?

If a large and complex spreahsheet if what you thought of – no, that won’t work. Spreadsheets take a long time to build and even longer to update. Most entrepreneurs who start financial planning with a spreadsheet give up very soon. It just takes way more time than you have available.

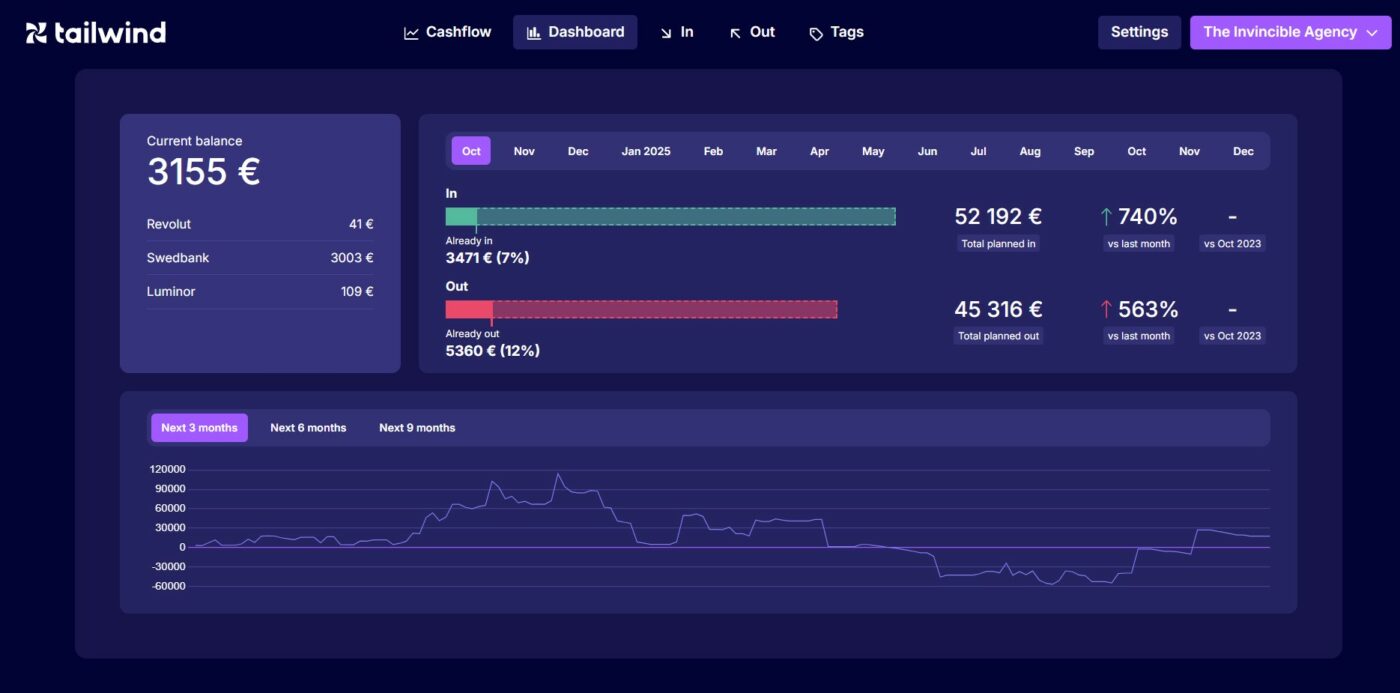

That’s why we built https://tailwindapp.eu – a visualized and automated financial planning tool for small business owners. It shows your cash flow as a visualization rather than a table with numbers. And allows to model all kinds of scenarios easily with “drag and drop”.

Your forecast securely works in sync with your bank account and updates itself every time you log in. The forecast always starts on today’s date. It allows to see both the past and the future and let’s you control cash flow per client or per project.

Tailwind allows you to predict expected cash balance on any future date. 5-10 minutes per week will be sufficient to be in control.

Large companies have finance departments and all kinds of technology. But we believe sound financial planning should be accessible to busy entrepreneurs as well. Check out Tailwind – chances are you will like it as much as Mārtiņš Vimba from Mappost: