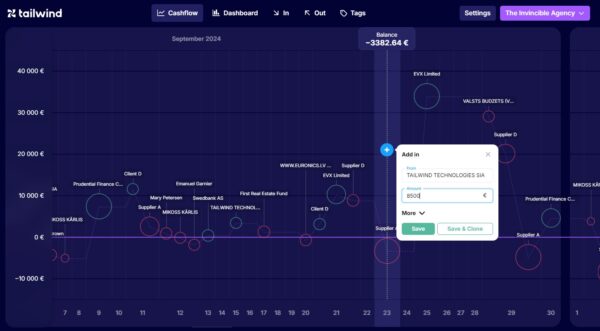

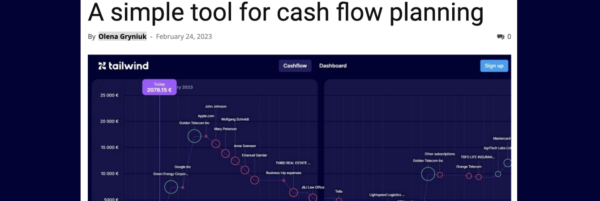

Bank sync doesn’t work? Renew the 90 day permission!

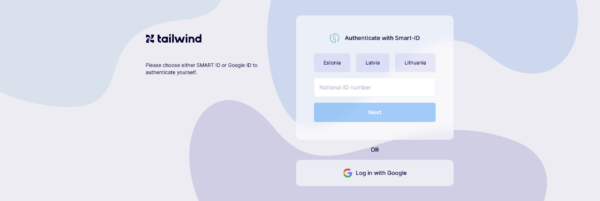

16 December 2024Why isn’t my bank sync working? Reason #1: the 90 day permission has expired. Automated data import from our bank accounts or “open banking” has made life so much easier for entrepreneurs and accountants. And tools like Tailwindapp.eu: Simple & Easy Cash Flow Forecasting were only made possible by open banking. It works like clockwork […]