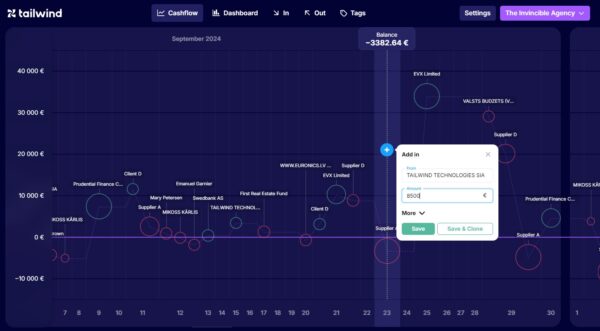

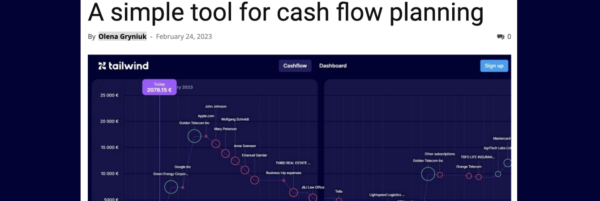

Import data from (almost) any system!

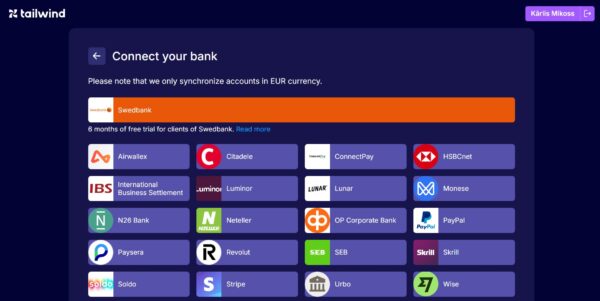

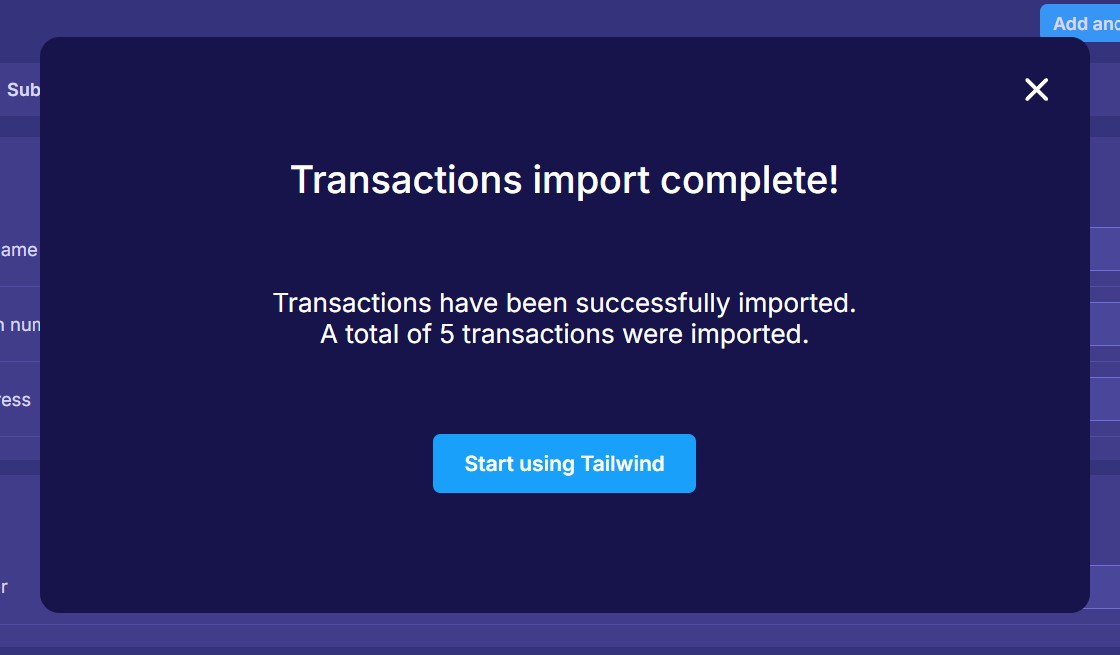

16 September 2025Does your company issue dozens of invoices at the beginning of every month? Then our new data upload feature will make things easier for you. Tailwind has supported data import from banks from the very beginning. You can sync your forecast with 2000+ banks in Europe and our users greatly appreciate it. It’s fairly straightforward […]